Next Generation of Tax Preparers in Action: Spotlight on Monticello High School, Academy of Finance

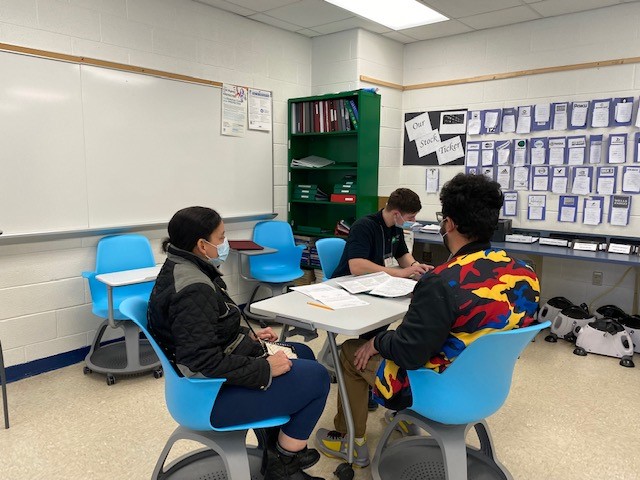

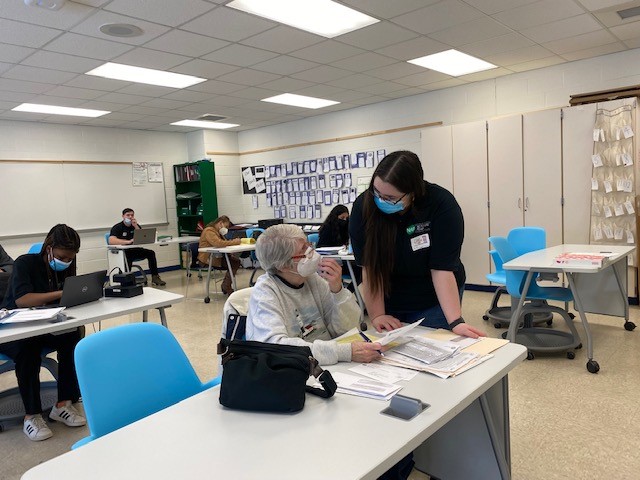

With the close of another tax season upon us, NAF students at Monticello High School, Academy of Finance are celebrating a job well done, as they have continued to give back to their community by preparing tax returns – free of charge. They have not only provided an essential service, especially during these last few years of the pandemic, but have built skills that will help them be successful in their next steps after high school – including customer service, problem-solving, time management, and more. Talk about being Future Ready!

“What I like the most about our VITA program is how it teaches students the value of giving back to their community.”

Celebrating their 15th year, The Volunteer Income Tax Assistance (VITA) program is an IRS program that requires all volunteers – including students – to be certified. NAF Academy of Finance Director, Susan Bahrenburg, who is also a CPA, teaches current tax law in a Financial Decision-Making class and gets young people ready for the certification exam. Bahrenburg and her colleague, who are the co-site coordinators, also take the exam and have expressed that it’s more challenging than any tax returns they’ve prepared. Once certified, academy students are able to prepare tax returns, perform quality reviews, and make phone calls to confirm appointments with the tax clients.

“What I like the most about our VITA program is how it teaches students the value of giving back to their community,” said Bahrenburg. “In addition, community residents get to interact with teenagers and see them in a wonderfully positive light. The students learn how to interact with people they don’t know in a professional manner, as they provide an important service to their community. The students also feel empowered that they know how to prepare tax returns, a skill most adults don’t understand!”

The academy normally prepares between 225 – 250 tax returns a year and saves taxpayers over $60,000 in tax prep fees. This year, they had a combination of in-person and remote appointments — with students preparing 155 tax returns and saving taxpayers over $37,525 in tax prep fees! Their clients are primarily low-income and senior citizens from Sullivan County, NY.

“It made me feel like a part of something bigger for my community. What I learned in class suddenly became a way to help people, going beyond just a paper,” said William W., AOF Student Tax Preparer.