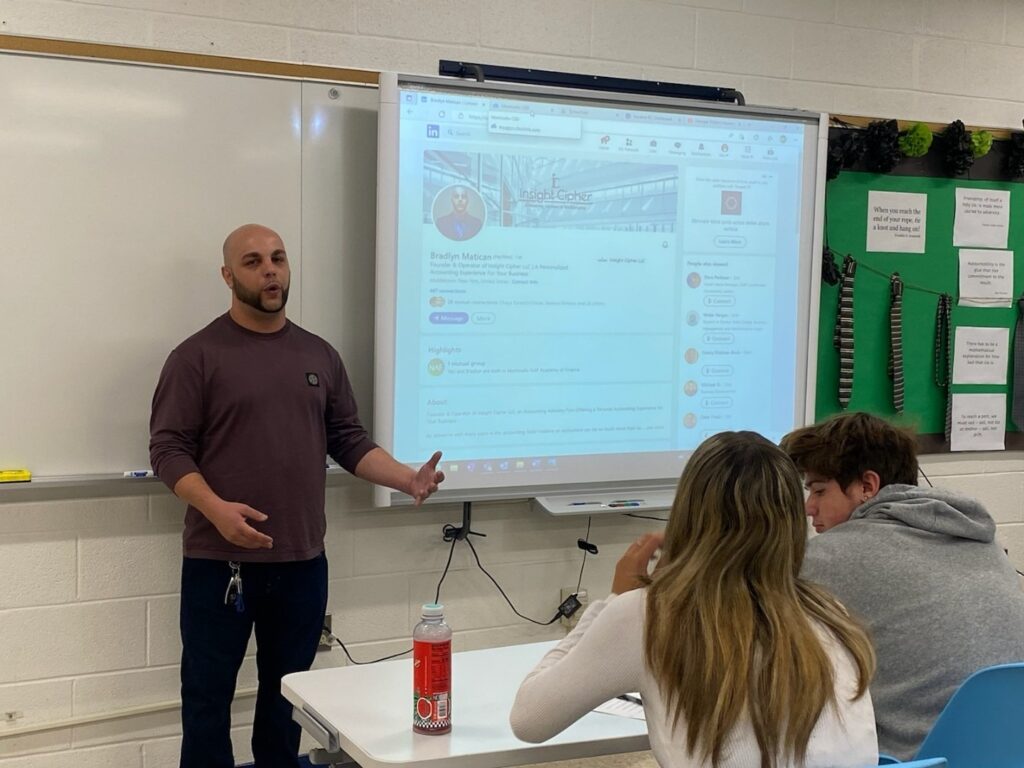

Putting Passion First: Q & A with NAF Alum, Bradlyn Matican, in Celebration of Financial Literacy Month

April is Financial Literacy Month—a time to spotlight the importance of financial empowerment, especially for young people preparing to navigate an increasingly complex world. In this spirit, we’re sharing NAF alumnus, Bradlyn Matican’s story. Bradlyn’s path began at the NAF Academy of Finance in Monticello, NY, where he discovered his affinity for accounting. That early exposure not only gave him a head start on financial literacy but also planted the seeds for a thriving and sustainable career. Read on for more about Bradlyn’s inspiring trajectory and his insights for generations on the rise.

Can you tell us about your experience at the Academy of Finance in Monticello? Did you have a favorite class or teacher?

While working at age 14, I heard about a high school student who was making more than minimum wage doing an internship at a bank and decided to apply to the NAF Academy of Finance (AOF) in my hometown of Monticello, NY. When I began my AOF journey, I quickly realized that aspects of my personality, skills and interests lent themselves to accounting. The AOF also provided me with the opportunity to participate in the Volunteer Income Tax Assistance or VITA program. The students are trained in how to file taxes for those in need, which was a valuable experience that I enjoyed and that bolstered my college applications.

When did you know you wanted to go into accounting?

I was attracted to Finance, and especially accounting, because the latter seemed like it had real-world application. During high school, securing an internship enabled me to really get a taste for what working in accounting would be like. I gained experience at Sullivan County BOCES—essentially the vocational schools department. At 17, I had my own office, which was pretty cool.

What was your college experience like? How do you feel NAF prepared you for college success?

I completed the majority of my bachelor’s degree at SUNY Oswego and finished up at SUNY New Paltz. I received my Masters (master’s in forensic accounting and Valuation) from SUNY Poly. I worked throughout my college to pay my way, but I will say that the internship I did while in the AOF put me in a good place to continue to earn more and progress in the field.

Tell us about your transition from higher education to the workplace.

I was fortunate enough to be able to start my career at an early age. While studying, I had the unique experience of working for a family friend. They needed all sorts of business and financial support, so I was able to get a range of experience in that role. Then I began working for the Catskill Distilling Company and then a large cheese company, acting as CFO at both. In 2019, I was near the end of my master’s program, and I felt like I could get the ball rolling on something different.

When did you know you wanted to start your own firm? What steps or accomplishments in your career got you to that point?

After working for other people and climbing the ranks, I felt very ready to be my own boss. I have always had the desire to work for myself and make my own schedule, so establishing my own business seemed like the logical next step.

What are some of the rewards and challenges you experience in running Insight Cipher, LLC?

In terms of challenges, I think when people start out on their own, they have a certain idea of how it will take off, and it tends to go at an unpredictable pace. Also, not everyone in your life may support the idea of taking the risk and going out on your own, and that can be deterring.

As for rewards, I love that I help small businesses grow and see people develop their success. My team consists of four remote individuals and myself, and the services Insight Cipher offers include Chief Financial Officer assistance, analytics, bookkeeping, tax assistance, and other financial services. Often, the time small business owners get back when they hire me allows them to do more of what they love and spend more time with their families. I enjoy seeing how my business positively impacts people’s lives.

April is Financial Literacy Month. What advice do you have for young people on achieving financial literacy and wellbeing?

I host a series of Financial Literacy workshops and I tend to see some guilt and emotion surrounding a person’s understanding of the system. So, my advice is: Do not be afraid or ashamed to seek the knowledge you need. The knowledge is more attainable than you may think.

I am on the board of nonprofits and the biggest thing I tell young people curious about financial literacy and wellbeing is: Start working. The sooner you start an internship or job in the field, the better. You build income, you build an understanding of what you do and do not want in a career, and you add lines to your resume.

If you had one piece of advice to offer a high school student looking toward his or her future, what would it be?

I was speaking with a mentee the other day, and she is interested in trying to find a job in engineering. I told her that, instead of pursuing a job at X or Y company, pursue a passion. Find what you are passionate about, whether it’s a topic or an area, and choose that as what to strive for. Instead of trying to fit yourself into the mold, find where the mold might suit you.